22++ How To Calculate Expected Rate Of Return On A Stock Ideas in 2022

How to calculate expected rate of return on a stock. Ad Choose from the leading companies and make profit by buying and selling their stocks. When calculating the expected return for an investment portfolio consider the following formula and variables. View the companys income statement to determine net income. Expected Rate of Return ERR R1 x W1 R2 x W2. The formula for expected rate of return looks like this. Expected price of dividend stocks One formula used to value dividend stocks is the Gordon constant growth model which assumes that a stocks dividend will continue to grow at a constant rate. Stocks price changes every day due to various reasons and you can earn big with it. Written as a formula we get. One year it returns 5 at a 75 probability and the next it earns 6 at a 80. 250 20 200 200 x 100 35 Therefore Adam realized a 35 return on his shares over the. For example lets say there are 2 years we are analyzing. In short its the sum of the average return rate and their probabilities over a given number of years.

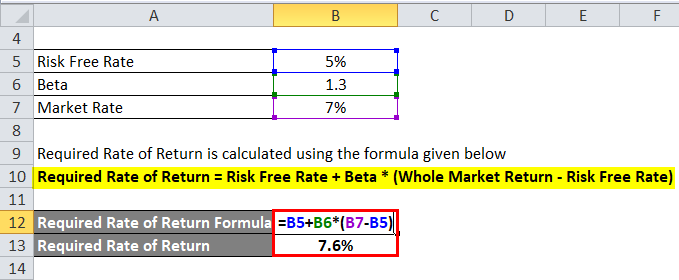

Ra rf βarm - rf For example suppose you estimate that the SP 500 index will rise 5 percent over the next three months the risk-free rate for the quarter is 01 percent and the beta of the XYZ Mutual Fund is 07. Expected Return SUM Returni x Probabilityi Where i indicates each known return and its respective probability in the series How to Calculate Expected Return Using Historical Data. To calculate the expected return using historical data youll want to take an average of each outcome. The following is the equation for the model. How to calculate expected rate of return on a stock XIRRB2B6A2A6 1 type the above formula in the formula box of cell C2 press enter key. Add in of expected share repurchases a year. To calculate the Expected return we can use the Capital Asset pricing model CAPM. 2 select the cell that contain rate of return C2 then right-click on it select Format Cell from the drop-down list. Expected Rate of Return Example. Expected return W1 R1 W2 R2. Stocks price changes every day due to various reasons and you can earn big with it. You then add each of those results together. In the short term the return on an investment can be considered a random variable Random Walk Theory The Random Walk Theory or the Random Walk Hypothesis is a mathematical model of the stock market.

1 Statistical Measures Of Standalone Risk Aa Aa Remember The Expected Value Of A Probability Distribution Homeworklib

1 Statistical Measures Of Standalone Risk Aa Aa Remember The Expected Value Of A Probability Distribution Homeworklib

How to calculate expected rate of return on a stock Er Rf β Rm Rf.

How to calculate expected rate of return on a stock. The expected return is the profit or loss that an investor anticipates on an investment that has known historical rates of return RoR. The expected rate of return is calculated using the formula above. To calculate expected rate of return you multiply the expected rate of return for each asset by that assets weight as part of the portfolio.

So you can use the below formula to calculate the rate of return for your stock. Expected return is calculated by multiplying potential outcomes returns by the chances of each outcome occurring and then calculating the sum of those results as shown below. It is calculated by multiplying potential outcomes by the.

Ad Choose from the leading companies and make profit by buying and selling their stocks. Add in current dividend yield. Divide the gain or loss by the original price to find the rate of return expressed as a decimal.

Calculate return from change in price-to-earnings multiple. The rate of return on stockholders equity is calculated by dividing average stockholders equity by net income. Multiply the rate of return expressed as a decimal by 100 to convert it to a percentage.

W Asset weight. R Rate of return. A companys net income equals its pretax income minus federal state and local taxes.

You will get the rate of return of the stock you bought. Plug all the numbers into the rate of return formula. The quick and easy way to find total return is to.

Continuing this example you would divide -6 by 50 to get -012. To find the expected return plug the variables into the CAPM equation.

How to calculate expected rate of return on a stock To find the expected return plug the variables into the CAPM equation.

How to calculate expected rate of return on a stock. Continuing this example you would divide -6 by 50 to get -012. The quick and easy way to find total return is to. Plug all the numbers into the rate of return formula. You will get the rate of return of the stock you bought. A companys net income equals its pretax income minus federal state and local taxes. R Rate of return. W Asset weight. Multiply the rate of return expressed as a decimal by 100 to convert it to a percentage. The rate of return on stockholders equity is calculated by dividing average stockholders equity by net income. Calculate return from change in price-to-earnings multiple. Divide the gain or loss by the original price to find the rate of return expressed as a decimal.

Add in current dividend yield. Ad Choose from the leading companies and make profit by buying and selling their stocks. How to calculate expected rate of return on a stock It is calculated by multiplying potential outcomes by the. Expected return is calculated by multiplying potential outcomes returns by the chances of each outcome occurring and then calculating the sum of those results as shown below. So you can use the below formula to calculate the rate of return for your stock. To calculate expected rate of return you multiply the expected rate of return for each asset by that assets weight as part of the portfolio. The expected rate of return is calculated using the formula above. The expected return is the profit or loss that an investor anticipates on an investment that has known historical rates of return RoR.

Indeed lately has been sought by consumers around us, perhaps one of you. Individuals now are accustomed to using the internet in gadgets to view image and video data for inspiration, and according to the title of the post I will discuss about How To Calculate Expected Rate Of Return On A Stock.

How to calculate expected rate of return on a stock. Continuing this example you would divide -6 by 50 to get -012. To find the expected return plug the variables into the CAPM equation. Continuing this example you would divide -6 by 50 to get -012. To find the expected return plug the variables into the CAPM equation.

If you are looking for How To Calculate Expected Rate Of Return On A Stock you've arrived at the right place. We have 51 images about how to calculate expected rate of return on a stock adding images, photos, pictures, backgrounds, and more. In such web page, we additionally have number of graphics available. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.