37++ How To Pay Off Bad Debt On Your Credit Report Information

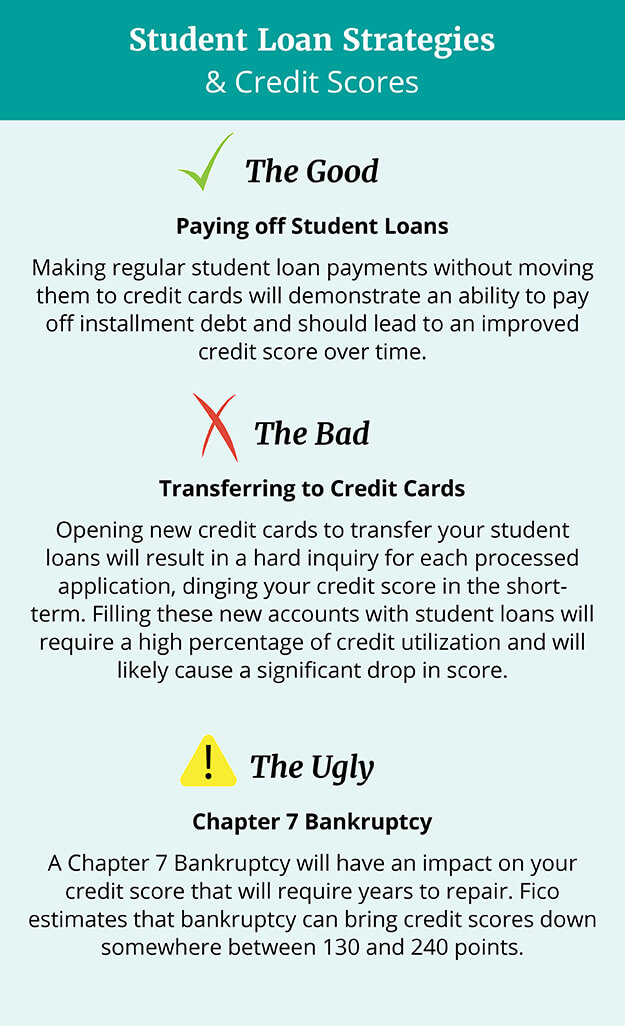

How to pay off bad debt on your credit report. If you are trying to clean up your credit and you have some extra cash the pay for delete technique is the easiest way to remove collections from your credit report. So after you repay the debt your FICO score may increase within 2 billing cycles. To ask for pay for delete youll need to send a written letter to the creditor or debt collection agency. Your credit report is a credit history. Explain that youre taking steps to repay your debts clean up your credit and be more responsible. This is best for collections under 500. You do not need to do anything to make that happen. Your credit report if youre not familiar is a document that lists your credit and loan accounts and payment histories with various banks and other financial institutions. One of the most effective ways to get negative items removed from your credit report is to pay the debt in exchange for the creditor removing the charge off from your credit report. The six-month mark is often also the point when your creditor might typically hand your debt off to a third-party collection agency or sell it to a debt buyer. You may find that some companies have sold your debt to collections agencies. If you pay off or settle a debt with a collection agency the status of the collection account on your credit report should update to paid or settled within a month or two.

9 File a Dispute with The Credit Bureau. Ask for the name and phone number of the person with the original creditor who has the authority to make this decision. Basically you will agree to pay the entire amount owed and they agree to remove the collection from your credit report. With this method youd use your payment as leverage to convince the debt collector to help restore your credit. How to pay off bad debt on your credit report Call that person and ask. Keep in mind that paid off accounts stay on credit report for 10 years. Usually creditors inform credit activities to credit bureaus once per month. To avoid a lawsuit try to settle your debts before a charge-off occurs. 6 Review Your Credit Report and Check for Mistakes. Call the creditor or the debt collector and see if you can negotiate a settlement. Reporting a bad debt to the bureaus might encourage a debtor to pay the amount owed in order to resolve the outstanding delinquency that appears on his credit report. However a creditor can ask to have paid-off debt removed from your credit profile. It not only shows whether or not your bills are being paid on time now but also whether they were late in the past.

How To Pay Off Credit Card Debt Best Strategies Money

How To Pay Off Credit Card Debt Best Strategies Money

How to pay off bad debt on your credit report Emphasize that a clean credit report will help you achieve your.

How to pay off bad debt on your credit report. Negotiate With Creditors Once a creditor or a collection agency reports a debt the reporting agencies -- Equifax Experian and TransUnion -- cannot remove it. First gather the list of your bad debt. You can negotiate a debt settlement arrangement directly with your lender or seek the help of a debt settlement company.

7 Ask the Creditor for Proof of the Debt. A great way to do this is to order your credit report. A pay for delete letter should include.

This strategy is usually employed when debts have already been sold to a debt collection agency. Requesting pay-for-delete means that the debtor offers to pay the debt partly or in full and in exchange the collector or original creditor agrees to delete the account from the credit report. But this works only on an unpaid charge off.

Most negative items will simply fall off your credit report automatically after seven years from the date of your first missed payment. 10 Determine the Statute of Limitations on Your Debt. Each late payment is recorded.

Debt collectors can pull your credit report and. Your ability to negotiate depends in part on how old the debt is the size of the balance and whether the creditor thinks you have the means to pay. It depends on various factors.

A company isnt required to. You should begin by listing the amounts you owe and the companies who currently hold your debt. The collection agency should notify the three national credit bureaus Experian TransUnion and Equifax to update their records.

Your name and address The creditor or collection. 11 Make Arrangements to Pay. 5 Steps to Remove Judgments and Collections from your Credit Report.

One of the most common myths about credit reports is that if you pay off a bad debt it will be deleted immediately.

How to pay off bad debt on your credit report One of the most common myths about credit reports is that if you pay off a bad debt it will be deleted immediately.

How to pay off bad debt on your credit report. 5 Steps to Remove Judgments and Collections from your Credit Report. 11 Make Arrangements to Pay. Your name and address The creditor or collection. The collection agency should notify the three national credit bureaus Experian TransUnion and Equifax to update their records. You should begin by listing the amounts you owe and the companies who currently hold your debt. A company isnt required to. It depends on various factors. Your ability to negotiate depends in part on how old the debt is the size of the balance and whether the creditor thinks you have the means to pay. Debt collectors can pull your credit report and. Each late payment is recorded. 10 Determine the Statute of Limitations on Your Debt.

Most negative items will simply fall off your credit report automatically after seven years from the date of your first missed payment. But this works only on an unpaid charge off. How to pay off bad debt on your credit report Requesting pay-for-delete means that the debtor offers to pay the debt partly or in full and in exchange the collector or original creditor agrees to delete the account from the credit report. This strategy is usually employed when debts have already been sold to a debt collection agency. A pay for delete letter should include. A great way to do this is to order your credit report. 7 Ask the Creditor for Proof of the Debt. You can negotiate a debt settlement arrangement directly with your lender or seek the help of a debt settlement company. First gather the list of your bad debt. Negotiate With Creditors Once a creditor or a collection agency reports a debt the reporting agencies -- Equifax Experian and TransUnion -- cannot remove it.

Indeed recently has been hunted by consumers around us, perhaps one of you. People are now accustomed to using the net in gadgets to view image and video information for inspiration, and according to the name of this post I will talk about about How To Pay Off Bad Debt On Your Credit Report.

How to pay off bad debt on your credit report. One of the most common myths about credit reports is that if you pay off a bad debt it will be deleted immediately. One of the most common myths about credit reports is that if you pay off a bad debt it will be deleted immediately.

If you are looking for How To Pay Off Bad Debt On Your Credit Report you've arrived at the perfect place. We ve got 51 graphics about how to pay off bad debt on your credit report including images, pictures, photos, wallpapers, and much more. In these webpage, we additionally have variety of images out there. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, translucent, etc.